Kay:

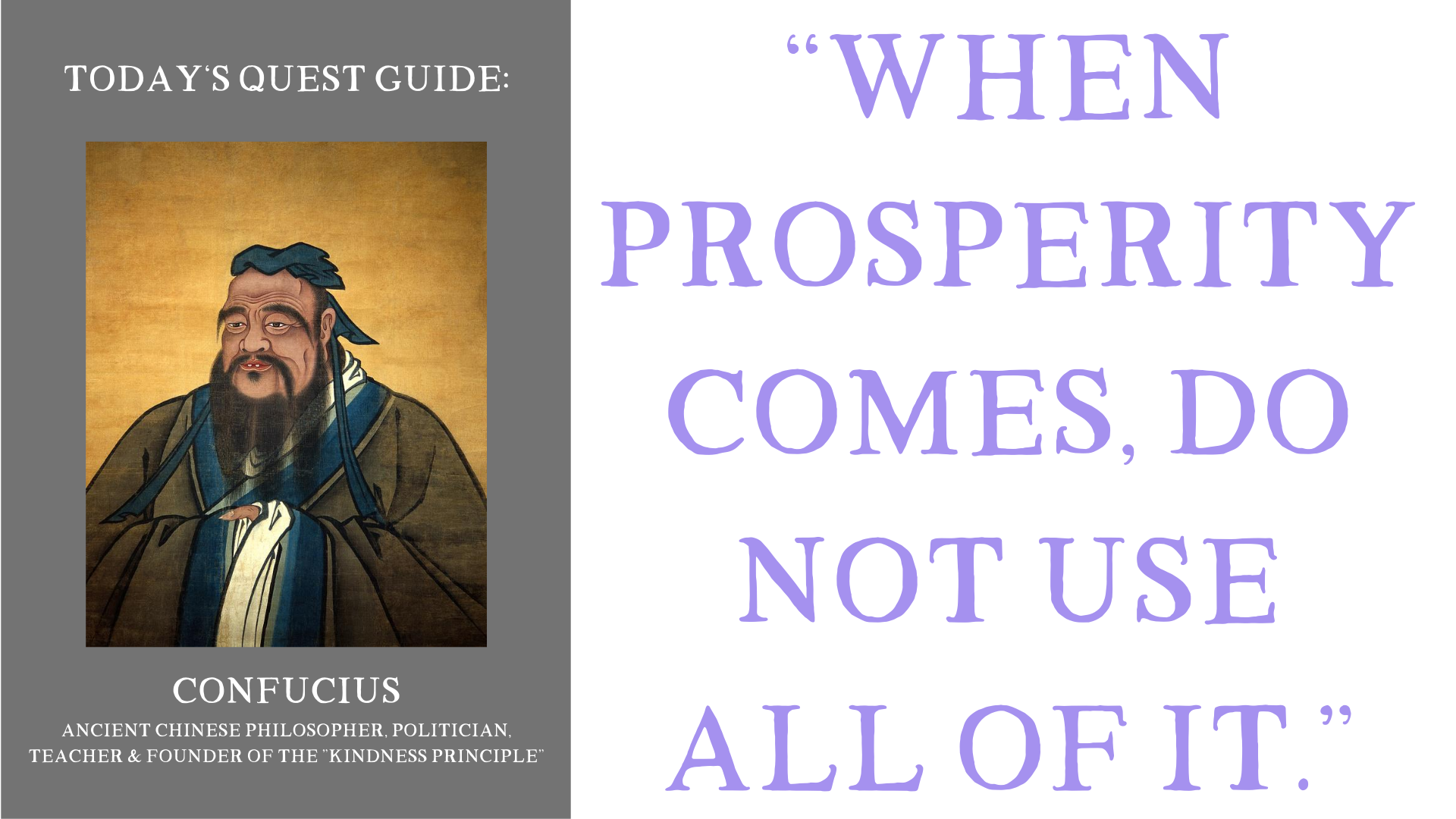

Hey there, Questers! Welcome back! It is August 6th, today’s Episode 154, and we have a Confucius quote for you today…

Shi:

“When prosperity comes, do not use all of it.”

Kay:

Oh, such practical wisdom from such an ancient guy!

Shi:

Sometimes we like to refer to certain books, quotes, or exercises as “eating our vegetables.”

Kay:

Oh, this is definitely a vegetables kind of quote. And, the practicality sense of it really might sound a little something like “saving for a rainy day”…

Shi:

Right? This is about being smart with your money, and not living outside of your bubble. This is some old fashioned advice. Or, shall I say, ancient advice from an ancient philosopher – which means that it’s oftentimes the best advice, because it’s been around the longest!

Kay:

Yep! So, be it getting a large rice crop in the Fall of AD, or be it coming into some money at a particular time in your life here in 2020, it’s a pretty good practice not to blow all of the abundance that you have available to you at one given time.

Shi:

Our entire society seems to be crafted around extracting all of your earnings from you. In this capitalist system of consumerism, buying, “keeping up with the Jones'”, and ALL of the things, it’s really hard not to buy into it. And, you know, (truth time!), I certainly have, at times in my life, been of the mindset where I thought, “If you make a thousand bucks, then SWEET…I got a thousand bucks to spend!”

Kay:

Yup. But, the reality of that situation, as many people who are approaching retirement age are finding, is that this is not a very good long term strategy for security and safety as you age, and as you get older…

Shi:

So, if you’ve been thinking that you need to become more quote on quote “financially literate” but you don’t know where to start, we have two suggestions for you! One is to read Unshakeable, by Tony Robbins. It’s a great sort of “starter” book – if you’re looking for some of those basic understandings of financial systems, including savings in general, how much you should be putting away, what a portfolio is, and things like that. Kay, I know you recently read the Dave Ramsey book that had a pretty big impact on you too…

Kay:

Yeah! It’s been about a year and a half since I read that particular book, but Dave Ramsey is a great teacher in general. I’m not remembering exactly what the book was title-wise, but, if you are like, “Hey, I’ve got this investment stuff down, but I seem to have a lot of money blockages, and a mindset around money that isn’t super healthy” – I would definitely suggest Get Rich, Lucky B****, by Denise Duffield Thomas, or, of course, The Millionaire Mind, by T. Harv Eker.

Shi:

It’s so tempting to live at the brink of your bubble, and sometimes even outside of it, but we all know that we should live inside that bubble. And so, trying to come away from this mindset of “saving for a rainy day” – because, you could see one dew drop outside and be like, “Oh, I spent all of my rainy day savings on going to the movies, or a nice night out,” or something like that. And so, we really want to be thinking about switching that mindset to investing in your future security so that you don’t blow it on something, or appropriate it for something else.

Kay:

Well, the mindset switch from “saving for a rainy day” to “investing in your future security” is such a great switch because it takes you out of saving money out of fear and puts you into saving money because of love. So, instead of saving money, because I fear something big and terrible in the future, I put money away because I love myself so much that I want to secure my future. And so, creating these new narratives around how we view money, where we think about money, how we love it, and, and even asking questions like – Do you love it? Do you think that it’s easy to get? Do you believe that you deserve it? – we can have a much healthier relationship with it! There are all kinds of money mindset things that can actually break us from even ever attempting the actual tactical habits that Dave Ramsey and Tony Robbins tell us, because we’re so gummed up with our money energy! I know it sounds a little “woo woo” – but it really makes a difference.

Shi:

Well, when you attack it from both angles of, 1. I need to clear my blockages, energetically speaking. (and) 2. I need those tactical tips in front of me – that’s what can really bring those positive results, and lasting change. You know, pretty much everyone says you start off with getting yourself to a thousand bucks of emergency money. And then, don’t touch it, leave it there, and work on leaving that and just letting it be. Some of us have this tendency to save up a little bit of money, and then spend it all, and then be back at square one, zero. So, once we get good at having our thousand dollars in emergency money, most financial experts say the next step is to have three months of your monthly expenses saved away just in case…I don’t know…a pandemic hits and your income goes away and unemployment doesn’t come through?! That ensures you’ve got a safety net during those times. And then, once you come beyond that, “I’ve got three months of expenses in savings and I can reliably start to accumulate money past that,” that’s when you start building your portfolio, and maybe looking at stocks and things. But, those are really the basic things that you need to start off on your money path!

Kay:

So, as Confucius says, “When prosperity comes, don’t use all of it.” And, remember, he’s not saying to save all of it. He’s saying don’t use every single penny, and put a little bit aside to invest in your future!

Shi:

Alright…That brings us to the quest! Of course, it’s a money quest, AND it’s a choose your own adventure quest! So, you can either find your last prosperity deposit – (whether it’s your paycheck, or a dividends check, or some other kind of gift) – and commit to taking a percentage of at least 5% and putting it towards your future…OR: If you don’t have a separate account yet – set one up today! If you have a separate account, then you can funnel money into your savings, which makes it a lot easier to leave it alone! So, are you ready?

Kay & Shi:

Let’s quest!