Kay:

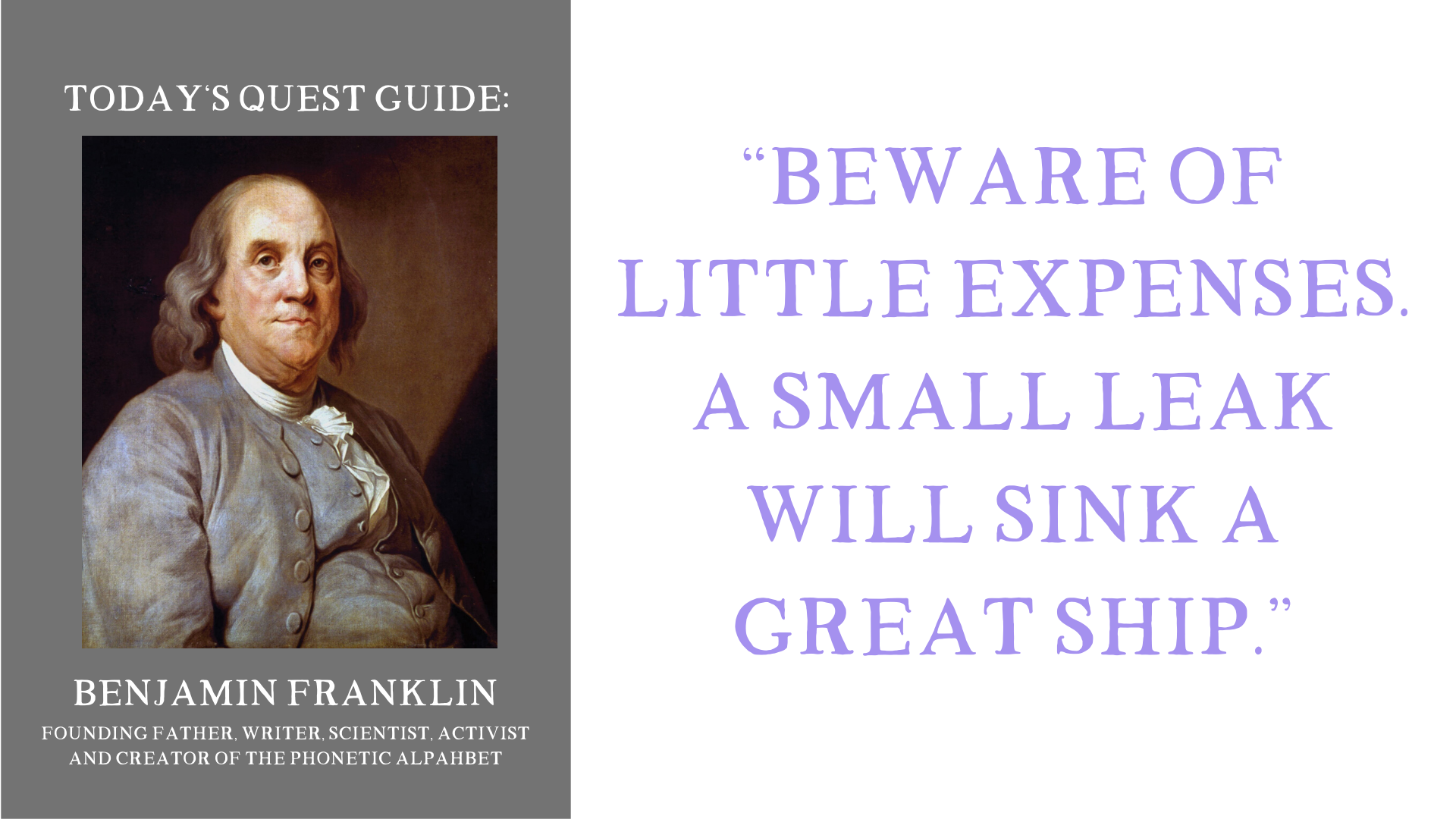

Hey there Questers, and welcome to Episode 111! Today is Monday, June 6th, and we have a quote coming to you from one of our founding fathers – Benjamin Franklin. He says, “Beware of little expenses. A small leak will sink a great ship.”

Shi:

Episode one, one, one! It’s a great way to start off the week with a quote from someone we do quote often, Mr. Benjamin Franklin! But, I think this is a great Monday quote because, oftentimes, we want to start new initiatives at the beginning of the week, and we feel most focused and dedicated towards what it is that we want to accomplish and get done. And, for many of us, finances is one of those things…

Kay:

Well, the money stuff is oftentimes the stuff that we avoid looking at until everything else in our lives is done and taken care of. And so, the money stuff is the “big frog”. And, as Brian Tracy would say, if all of the things you have to do are frogs, then get the big one over with first. And, what a better day to start than on a Monday! So, we’re going to talk a little bit about ways that you might be able to find some holes that are sinking your ships!

Shi:

Finances is one of those things that can sink a ship REAL fast. And, what Mr. Franklin is referring to here is that the little stuff adds up. And, of course, this applies metaphorically, but it also applies really practically when we’re talking about our expenses and our finances. And, I’ll be honest. I’ll be the first one to say that I just don’t like talking about money. I feel like I get sensitive about money, and it can be frustrating! And so, I used to say my philosophy was that I would just make so much money, that I wouldn’t have to worry about it.

Kay:

I think that’s probably a product of growing up really close to the poverty line. You know, when Shila was born, our parents were on food stamps and welfare. And so, money is hard. It causes stress. It’s difficult to get. And those are all poverty mindset thoughts, and that can be difficult to pull yourself out of. And, our parents learned to think better and to do better and were able to pull themselves, as well as our family, out of that environment…but, they did so very intentionally. And, one of the ways we’ve seen their example of frugality accumulate into our lives, and – more specifically – our restaurants has been in the examples of salsas, sour, creams, and butters!

Kay & Shi:

*(Laughter)*

Shi:

Yup! These are the little side cups that come with your meals. And, if you’ve ever been in a restaurant, and you’ve asked for an extra side of ranch, you may or may not notice that that side of ranch ends up on your bill. And, this was something early on that we had to look at. There’s this business book that talks about – if you mind the pennies, the dollars mind themselves…mind the cents, and the rest will take care of itself! And so, we really looked at where some areas were where we could mind the pennies in order to make those dollars accumulate. And so, through our business life, over the last 17 years, this salsa, ranch, butter and sour cream example has been really useful for us in demonstrating this principle that Mr. Franklin is talking about here. Because, if you think about it: a side of salsa is 75 cents, and a side of ranch is a quarter. And so, originally, we were like, “Who cares about the quarter?” But, if you take that quarter, and you give away just one side of ranch, every single day, you’re looking at hundreds of dollars every year! And that’s just ONE side of ranch that causes each server to give away $2 a day worth of free product. And, that adds up to THOUSANDS of dollars at the end of the year. And, in a restaurant industry, where the profit margins are razor thin, that can be the difference between black and red!

Kay:

And this shows up so much in our lives now with the little expenses that come by – whether that be fees you’re not aware that you’re paying, or some subscription services that may or may not be healthy for you. I think that the sneakiest ones now are the ones that come in quarterly, because you have enough time to forget about canceling your next one, even if you don’t have the money to get it. And then, BOOM – you get that $99, or the $49, or the $79 charge on your account. And, you’re like, “I don’t even know if I wanted the collection of lotions and things that came in this box.” And, that actually happened with me once. I neglected a Fabletics subscription and allowed it to go, and go, and go. Even though I knew that we weren’t really in the space to afford that at the time. Until, one day, it actually ended up overdrawing my account. And, before I knew it, it was sinking my financial ship, because I had charges on my bank from having a late fee.

Shi:

Talk about the compounding effects of letting those little leaks go! So, to remind you, on your Monday, the quote today for Episode 111 is from Benjamin Franklin. And, he says, “Beware of little expenses, a small leak will sink a great ship.”

Kay:

So – your quest for the day is to: Plug a small leak! Find some of the loose change that’s in your car and go put it into your bank account. Get that oil change that you’ve been setting off. Set the intention to cut back! Take a look at the subscription services that are inside your bank, and choose to cancel one that may not be relevant to you. Get out there and find a way to make a difference, by plugging up one of those little holes that might be sinking your ship!

Shi:

Are you ready?! Let’s quest!