Kay:

Hey there Questers, and welcome back! It is September 1st (whoop, whoop!)…

Shi:

Woo-hoo!

Kay:

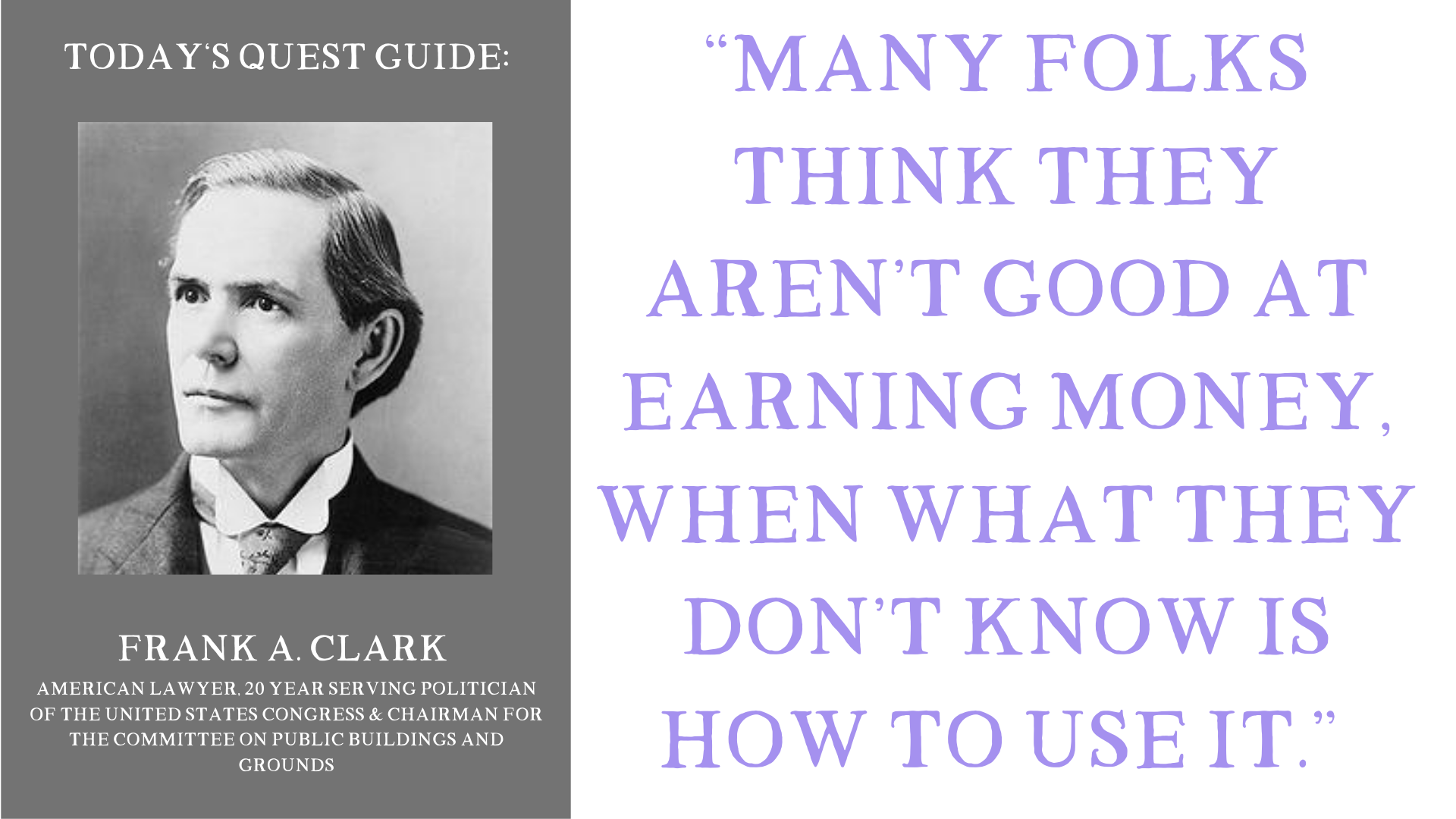

… first day of the month! This is Episode 172, and today’s quote is, “Many folks think they aren’t good at earning money, when what they don’t know is how to use it.” And, this quote is from Frank A. Clark!

Shi:

Now, you might not have heard of Frank A. Clark….We hadn’t either – #TruthTime. But, he’s an American lawyer, and he’s been serving as a politician to the United States Congress for 20 years. He’s also the chairman for the committee on public buildings and grounds. So, he’s got a solid career behind him, he’s well-known for giving financial advice and talking on some of these topics, and – this advice of his – is just plain good!…even though at first, it kind of sounds like…huh?

Kay:

Right? Well, at first you might think, “Wait, what? I don’t know how to use my money?”

Shi:

Like, “Oh, trust me, I know how to use my money!”

Kay:

Oh, I can use that money!

Shi:

You give it to me…I’ll show you 😉

Kay:

Many folks think that the reason that they don’t have enough money in their lives, or that they aren’t as abundant as they would like, is because they don’t bring in enough money or they just aren’t good at getting out there and earning it.

Shi:

What Mr. Clark is telling us is that we should shift our focus from earning the money (by exchanging our time for money), and instead shift our focus to using the money that we have wisely, and use that money in exchange for making more money…

Kay:

Now, a lot of people live in that poverty mindset, (and this is probably not the place that you are in), but maybe you have some habits that are born out of this. A poverty mindset, from just an economic range, often ends up in people getting lump sums of money that are usually small, and then, those people going out, (without the knowledge of budgeting for groceries, without the knowledge of how to spend that money wisely), and they get excited, and they buy a bunch of stuff that they need right away, they eat at McDonald’s for a family of five or six, and, before you know it, boom – there’s no more money and they are broke once again…

Shi:

The poverty mindset can show up in more subtle ways, too, when we’re maybe a little bit farther down the path, and you think, “Well, I don’t worry about money. I don’t have that issue anymore. I know that I’ve got to save money for vacations or those kinds of things…” But, when we really look at, does that also mean you have an emergency fund set aside, and then, from there, are you in the stock market? Do you have a portfolio? And, are you siphoning off some of your money every month to go into some kind of what we like to call a money machine, that then earns money by being money…Because, that’s where we really can shift out of that poverty mindset, and into an abundance mindset, and into a financially strategic mindset, that says, “Earn the money one time, and then use it to earn more money, and stop trading your time for money, and instead trade money for money. Now, granted, we’re still working on that as well, but we’re working on getting farther and farther along down that path, and it’s about making more use of the money that does come in, rather than hoping, and wondering how you can earn more of it.

Kay:

Now, you guys might be saying to yourself, “Wait, what? Money can earn money just for being money?”

Shi:

It’s true!

Kay:

It is true, and it isn’t something that earns a great amount of money….You’re not going to put $100,000 into an investment account, (or even $1,000 dollars into an investment account), and next year, have it turn into 2,000, 3,000, 4,000, $5,000…It doesn’t work like that. But, the compounding, over time, of 20 to 25 years of an investment can really set up a retirement…It can set up a house buy…It can set up a college fund…It can set up anything, really, that you’re looking to have. So, by knowing how much money to set aside, and knowing how much money to invest into your future, you’re just putting drops in your bucket for the “some day,” (it’s not saving for a rainy day…it’s investing in your future). And then, deciding how much money you want to live on, and then how much money you choose to tithe and to give away, are all really important factors too.

Shi:

One of the things that I really like, Kay, when we’re talking about money, is this idea of spending intentionally. Now, this does not mean you’re needing to be shamed for buying the latte…

Kay:

Right? No!

Shi:

That’s not what this is about…that $4 a day coffee habit…It’s about knowing where you spend your money and choosing to do it consciously. Get the latte, but do it from a place of conscious empowerment about your finances, not by being blind to them, and then, at the end of the month, saying, “Well, I’ll try and save again next month.” Do the latte, but do it consciously!

Kay:

Right? Have the latte and have your financial peace of mind as well! Know what things you’re willing to spend on, and what things that you’re willing to sacrifice on. A poverty mindset will often think that, “I don’t have money to invest in myself,” but you don’t have money because you don’t invest in yourself! So, you can see how these subtle shifts in thinking can make big dividends in the long run.

Shi:

So, just to remind you, today’s quote came from Frank Clark, who says, “Many folks think they aren’t good at earning money, when what they don’t know is how to use it.”

Kay:

So, today’s quest is a coin quest for you all! Today, we ask you to invest your money in some way. Now, this could be an investment in your personal growth, through purchasing an online course, or it could be financially investing in some stocks. You can download the Robinhood app for free and start investing for as little as $10. You could invest in real estate, or even just a book on finances!…We would suggest the Money Mindset or Money, Master the Game, by Tony Robbins. Whatever it is, find one way to use your money to benefit your future today! Are you ready?

Kay & Shi:

Let’s quest!